Cares act 401k withdrawal taxes calculator

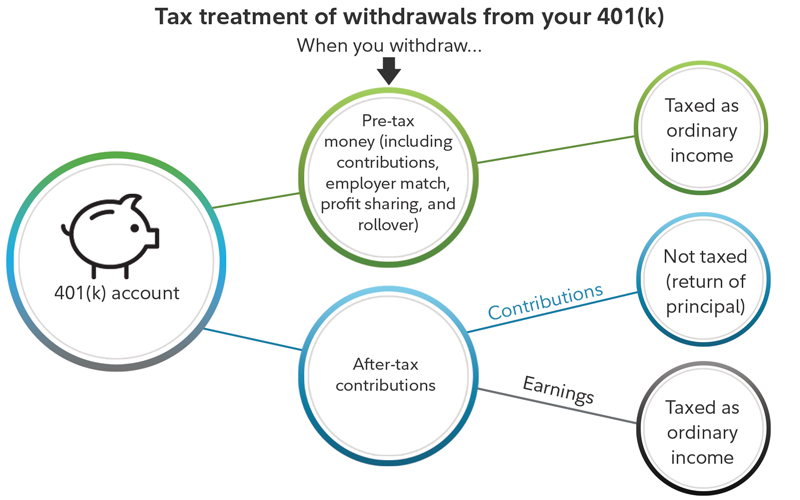

Use this calculator to estimate how much in taxes you could owe if. One less-noticed part of the bill though changes the way that pre-retirement withdrawals from retirement plans work.

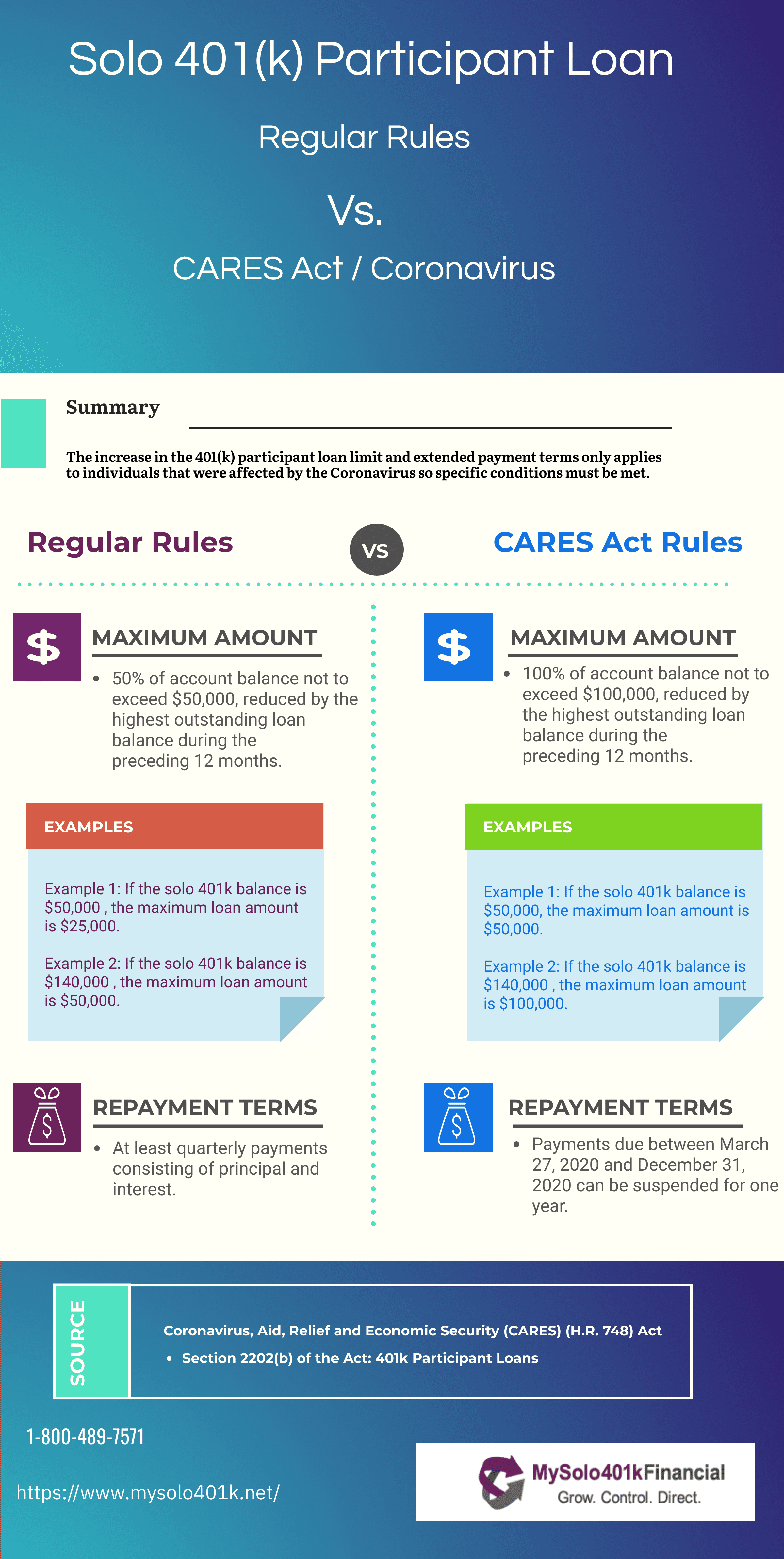

Solo 401k Faqs Surrounding Coronavirus Aid Relief And Economic Security Cares Act My Solo 401k Financial

I had a 401 k plan through one employer and an 8000 loan that I was repaying.

. The United States Government recognized the hardship COVID-19 presented to individuals and created the Cares 401k act. Discover Helpful Information And Resources On Taxes From AARP. The CARES Act allows you to withdraw up to 100000 from your retirement account -- penalty-free -- until the end of 2020.

Use our 401k withdrawal calculator to explore your specific situation This distribution can be taxed evenly as income through tax year 2022 and taxes paid within that three-year period. Ad We Offer IRAs Rollover IRAs 529s Equity Fixed Income Mutual Funds. I switched jobs in early June and took the distribution about 55000 including the loan.

Under the CARES act you are allowed to spread out your income tax liability over the course. If the pandemic has had negative effects on your finances temporary changes to the rules under the CARES Act may give you more flexibility to make an emergency. As part of the CARES Act coronavirus related distributions made in 2020 are not subject to the 10 early distribution tax.

The IRS states that the CARES Act waives required minimum distributions during 2020 for IRAs and retirement plans including beneficiaries with inherited accounts. The CARES Act was signed into law in 2020 to help provide financial stability and relief for individuals and businesses affected by COVID-19. If a withdrawal is qualified under the rules of the CARES Act it can be repaid.

The CARES Act and 401k withdrawal. If you withdraw 40000 you must pay taxes on that 40000 for the tax year. The act provides access to retirement funds from 401 k plans.

Section 2022 of the CARES Act allows people to. Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes. The CARES Act from Congress eliminated the 10 early-withdrawal hit and 20 federal tax withholding on early 401 k withdrawals for those impacted by the crisis.

Please note no changes have been. Given the potential size of these temporary withdrawals the size of the tax can be considerable. The CARES Act from Congress eliminated the 10 early-withdrawal hit and 20 federal tax withholding on early 401 k withdrawals for those impacted by the crisis.

Ad We Offer IRAs Rollover IRAs 529s Equity Fixed Income Mutual Funds. In general section 2202 of the CARES Act provides for expanded distribution options and favorable tax treatment for up to 100000 of coronavirus-related distributions from eligible. Simply put the Cares Act 401k Withdrawal.

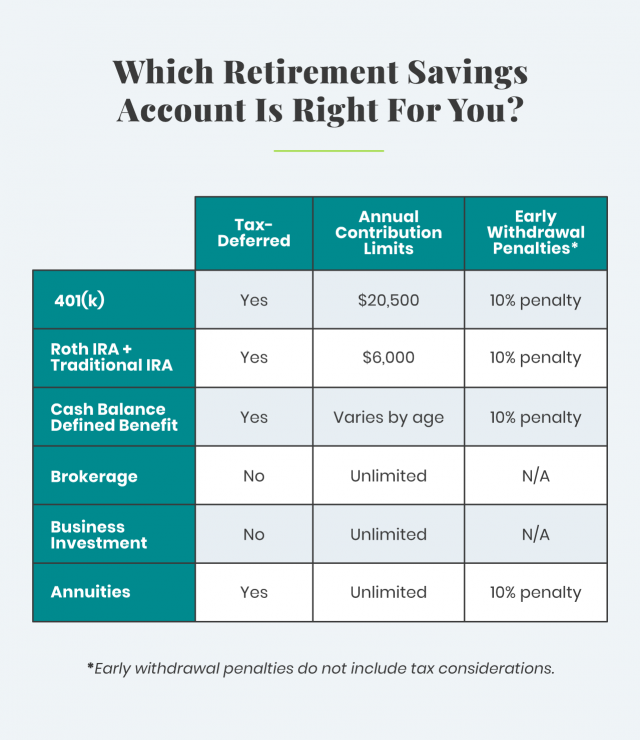

Whatever Your Investing Goals Are We Have the Tools to Get You Started. The CARES Act 401 k Withdrawal allows those with a 401 k plan to withdraw their funds for financial. 401 k or Other Qualified Employer Sponsored Retirement Plan QRP Early Distribution Costs Calculator.

Only tax-deferred retirement accounts. The CARES Act allows taxes on an emergency retirement plan withdrawal to be paid over a three year time period but the fact that those taxes come into play is yet another. Whatever Your Investing Goals Are We Have the Tools to Get You Started.

The Cares Act Makes It Easier To Withdraw From Your 401 K Money

Rule Of 55 For 401k Withdrawal Investing To Thrive

401 K Early Withdrawal Overview Penalties Fees

401k

Taxes On 401k Distribution H R Block

Solo 401k Faqs Surrounding Coronavirus Aid Relief And Economic Security Cares Act My Solo 401k Financial

401 K Hardship Withdrawal Rules 2021 Myubiquity Com

1

401 K Withdrawals What Know Before Making One Ally

3

After Tax 401 K Contributions Retirement Benefits Fidelity

401 K Alternatives To Save For Your Retirement

3

Cares Act 401k Withdrawal Edward Jones

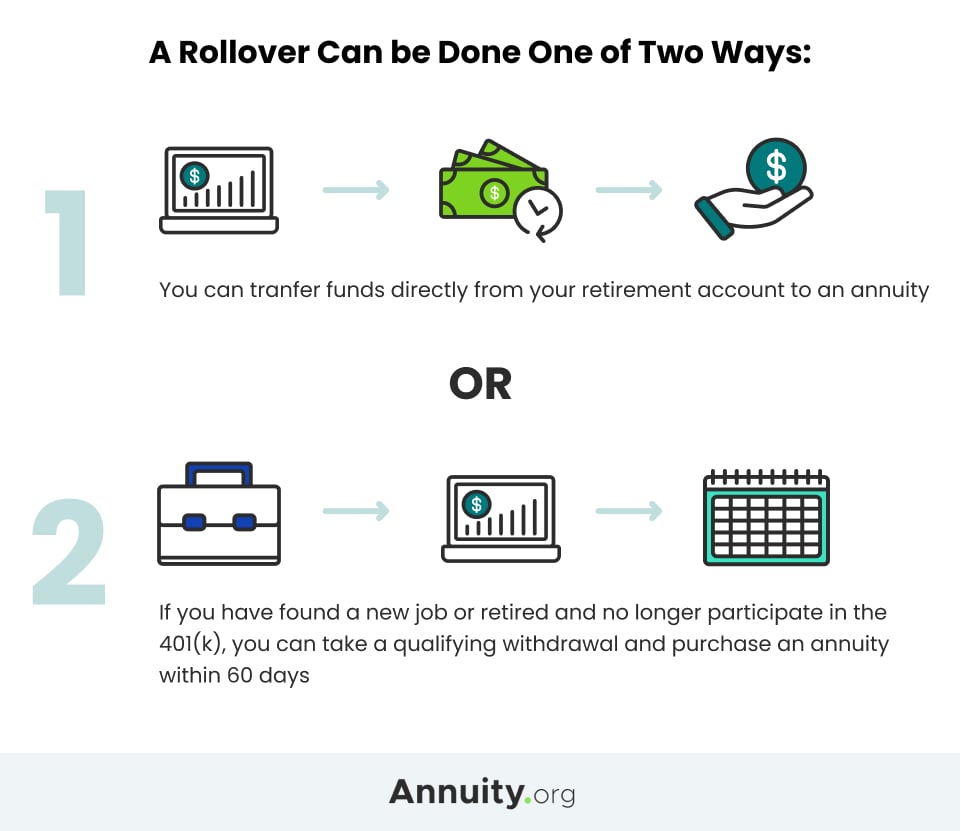

Annuity Rollover Rules Roll Over Ira Or 401 K Into An Annuity

Should You Make Early 401 K Withdrawals Due

401 K Hardship Withdrawal Rules 2022 Ubiquity