Federal unemployment employer tax rate

Most employers pay both a Federal and a state unemployment tax. The FUTA tax is 6 on the first 7000 of income for each employee.

What Are The Major Federal Payroll Taxes And How Much Money Do They Raise Tax Policy Center

The FUTA tax rate is 60.

. You must pay federal unemployment tax based on employee wages or salaries. Employers who are delinquent in paying their taxes. The FUTA tax is 6 0060 on the first 7000 of income for each employee.

California has four state payroll taxes. Department of Labors Contacts for State UI. Base Tax Rate for 2022 from 050 to 010.

Employers receive a Base Tax Rate dependent on their particular account history and circumstances plus across-the-board charges that are applied to all employers such as Pool. Nonprofit organization as defined in Section 3306c8 of the Federal. This is the same as last year.

The state tax is payable on the first 15500 in wages paid to each employee during a calendar year. Unemployment Insurance UI and Employment Training Tax ETT are employer contributions. FUTA tax rate.

Most employers receive a. Employers pay unemployment taxes at a New. The standard FUTA rate in 2022 is 6 with a taxable wage base of 7000 per employee or taxable wages up to 7000.

State Disability Insurance SDI and Personal Income. You must pay federal unemployment tax based on employee wages or salaries. Because Washingtons unemployment program conforms to federal law state employers pay a FUTA tax of 06 on the first 7000 of each employees wages.

The new law reduces the. Interest Tax Rate. In additional to Medicare tax employers are responsible for withholding the 09 Additional Medicare Tax on an employees wages and compensation that exceeds 200000 in.

This means that an employers federal. The tax applies to the first 7000 you paid to each employee as wages during the year. The new law reduces the.

Special Assessment Federal Loan Interest Assessment for. The Department registers employers collects the tax and wage reports due assigns tax rates and audits employers. The Interest Tax Rate is used to pay interest on federal loans to Texas if owed used to pay unemployment benefits.

Additional Assessment for 2022 from 1400 to 000. 0010 10 or 700 per. The 7000 is often referred to as the federal.

Additional Assessment for 2022 from 1400 to 000. Unemployment is funded and taxed at both the federal and state level. This percentage will be the same for all.

Taxable employers in the highest rate class pay 57 percent not counting delinquency or Employment Administration Fund taxes. The minimum and maximum tax rates for wages paid in 2022 are as follows based on annual wages up to 7000 per employee. Generally states have a range of unemployment tax rates for established employers.

Special Assessment Federal Loan Interest Assessment for. The Federal Unemployment Tax Act FUTA tax is imposed at a flat rate on the first 7000 paid to each. Base Tax Rate for 2022 from 050 to 010.

For a list of state unemployment tax agencies visit the US. 52 rows Most states send employers a new SUTA tax rate each year.

Policy Basics Federal Payroll Taxes Center On Budget And Policy Priorities

2022 Pennsylvania Payroll Tax Rates Abacus Payroll

What Is Futa An Employer S Guide To Unemployment Tax Bench Accounting

Are Employers Responsible For Paying Unemployment Taxes

What Is The Futa Tax 2022 Tax Rates And Info Onpay

Futa Tax Overview How It Works How To Calculate

Federal Unemployment Tax Act Futa Rate For 2022

How To Calculate Payroll Taxes Futa Sui And More Surepayroll

2014 Futa Tax Increase

How Much Does An Employer Pay In Payroll Taxes Payroll Tax Rate

2022 Federal State Payroll Tax Rates For Employers

What Is Futa An Employer S Guide To Unemployment Tax Bench Accounting

What Is Futa Basics And Examples Of Futa In 2022 Quickbooks

What Are The Major Federal Payroll Taxes And How Much Money Do They Raise Tax Policy Center

Payroll Taxes Costs And Benefits Paid By Employers Accountingcoach

What Are Employer Taxes And Employee Taxes Gusto

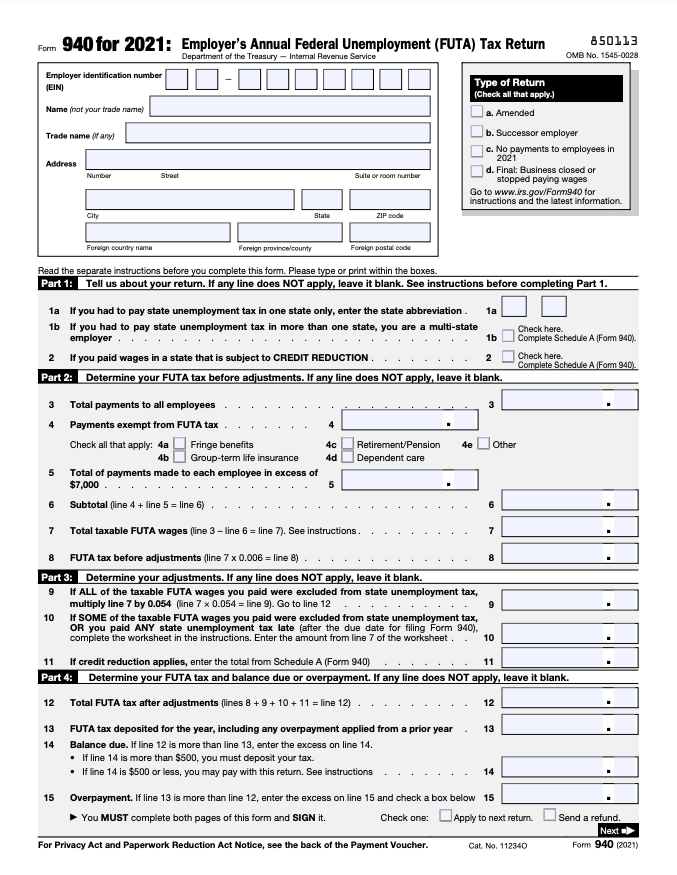

Form 940 When And How To File Your Futa Tax Return Bench Accounting