Canada Housing Benefit

Grants and contributions that support jobs training and. Housing or utilities benefit.

Here S How You Can Get An Extra 500 From The Canada Housing Benefit Urbanized

All inquiries for applications on or after March 15 th 2020.

. This becomes a particular concern with limited. To get ready for the proposed measures make sure to file your 2021 taxes and check that you have access to your CRA My Account. One-Time Top-Up to the Canada Housing Benefit.

Moreover the Canada Housing Benefit even got a recent top-up by the federal government that is being administered by the Canada Revenue Agency a unique exception to how things typically run. With this top-up low-income families where households earn less than 35000 and individuals earn less than 20000 might be eligible for a one-off. To receive benefit payments you must have filed a 2021 tax return and must currently be receiving the Canada Child Benefit.

The housing market is no different. Get ready to apply before the applications open on December 12 2022. 1 2022 and June 30 2023.

One-time top-up to the Canada Housing Benefit. News Corp is a global diversified media and information services company focused on creating and distributing authoritative and engaging content and other products and services. Knowledge and expertise to help make affordable housing a reality.

Share this article in your social network. All inquiries for applications before March 15 th 2020. The Canada Workers Benefit will help Canadians who work but still struggle.

Explore homebuyer and rental guides use mortgage calculators renovation and maintenance tips. Eviction bans and suspensions to support renters. Sun Belt and Rocky Mountain cities like Boise Idaho were at the forefront of home price growth in 2020 and 2021.

Transparency Accessibility Plan. You may be eligible for a tax-free one-time payment of 500 if your income and the amount that you pay on rent qualify. The government has announced new proposed financial support to help low-income renters with their housing costs.

If you provide an employee including the superintendent of an apartment block with a house apartment or similar accommodation rent free or for less than the fair market value FMV of such accommodation there is a taxable benefit for the employee. The Canada Housing Benefit is a benefit that was introduced to Canada and is administered through the provinces to help lower-income Canadians better afford rent. Markets are due for declines.

The proposed one-time top-up to the Canada Housing Benefit program would consist of a tax-free payment of 500 to provide direct support to low-income rentersthose most exposed to inflationwho are experiencing housing affordability challenges. Housing rebate financial assistance for home repairs improve accessibility for disabled occupants increase energy-efficiency. Contact Service Canada at.

The Ontario child benefit OCB is a non-taxable amount paid to help low- to moderate-income families provide for their children. One-Time Top-Up to the Canada Housing Benefit. To receive the OCB you and your spouse or common-law partner need to file your income tax and benefit returns and be.

The Canada Revenue Agency CRA administers this one-time payment. Because of the Canada Workers Benefit a lower-income worker earning 15000 a year could receive up to nearly 500 more from the program in 2019 than they received in 2018. Canadas housing affordability problem too big for governments to solve alone.

Look at housing options expected costs and your personal financial situation. It said while lower income households need support such as the federal governments Canada Housing Benefit there are concerns with such subsidies as they encourage landlords to charge higher rents. GSTHST housing rebate buying a home and financial assistance to fix your home.

In October those same regions led the nation. Such as the Canada Workers Benefit the Canada Child Benefit the Goods and Services Tax. Board of directors and committees.

ReMax Canadas 2023 housing outlook shows cities such as Calgary and Halifax are set to see price growth while major Ontario and BC. Canadas National Housing Strategy is a 10-year 40-billion plan creating a new generation of housing in Canada giving more Canadians a place to call home. Transparency Accessibility Plan Accessibility Feedback Canada Mortgage and Housing Corporation CMHC 2022.

Eviction bans and suspensions to support renters. Payment dates for recurring Government of Canada benefit payments. Job opportunities work permits Social Insurance Number criminal record checks and security clearances.

That is as much as 1100 to handle unexpected costs and help plan for the future. New benefit for renters. 1 2022 who received dental care between Oct.

Student aid and education planning. Bill C-31 which also includes a one-time housing benefit of 500 for low-income renters still needs royal assent before it is signed into law. Explore student aid and career options.

The benefit is tied to the household and can be used to help pay rent anywhere in Ontario. In addition the government indicated you should book a dental. This provincially administered benefit is available to eligible priority groups who are on.

You may be eligible to apply if your income and the amount that you pay on rent qualify. The Canada Ontario Housing Benefit COHB program provides households with a portable housing benefit to assist with rental costs in the private housing market. Contact Service Canada at.

Proposed new benefit for renters announced. Canada Pension Plan Old Age Security Guaranteed Income Supplement Retirement planning. Each province has its own system for accessing the money but per the Prime Ministers Office families who qualify for the federal benefit must have an income of less than 35000.

White Ribbon is the worlds largest movement of men and boys working to end violence against women and girls promote gender equity healthy relationships and a new vision of masculinity. To apply for this new federal one-time payment you. Plan for an education save budget.

If you applied using Employment Insurance Service Canada Ask about the status of your CERB payment. One-Time Top-Up to the Canada Housing Benefit. Click through to learn more.

Eviction bans and suspensions to support renters. Consultez Radio-Canada International pour découvrir et comprendre les valeurs démocratiques et culturelles des Canadiens de toutes origines en 7 langues. The one-time top-up to the Canada Housing Benefit aims to help low-income renters with the cost of renting.

The OCB and the Canada child benefit CCB are delivered together in one monthly payment. You have to estimate a reasonable amount for the housing. The new one-time top-up to the Canada Housing Benefit aims to help low-income renters with their housing costs.

The first benefit period is for children under 12 years old as of Dec. Key roles and responsibilities. Contact Service Canada at.

Finance Canada On Twitter 3 3 Bill C 31 Also Implements A One Time Top Up To The Canada Housing Benefit Which Will Provide A Tax Free Payment Of 500 Directly To Eligible Low Income Renters Applications For

Canada Nwt Housing Benefit To Get 19 2 Million

Ynsbbrwcahkdpm

How To Apply For Canada S New Rental And Dental Benefits Ctv News

Liberals Detail 40b For 10 Year National Housing Strategy Introduce Canada Housing Benefit Cbc News

Is Chb Canada Housing Benefit Social Assistance

Provincial Rent Support From 444 Million Investment In Canada Alberta Housing Benefit Lethbridge News Now

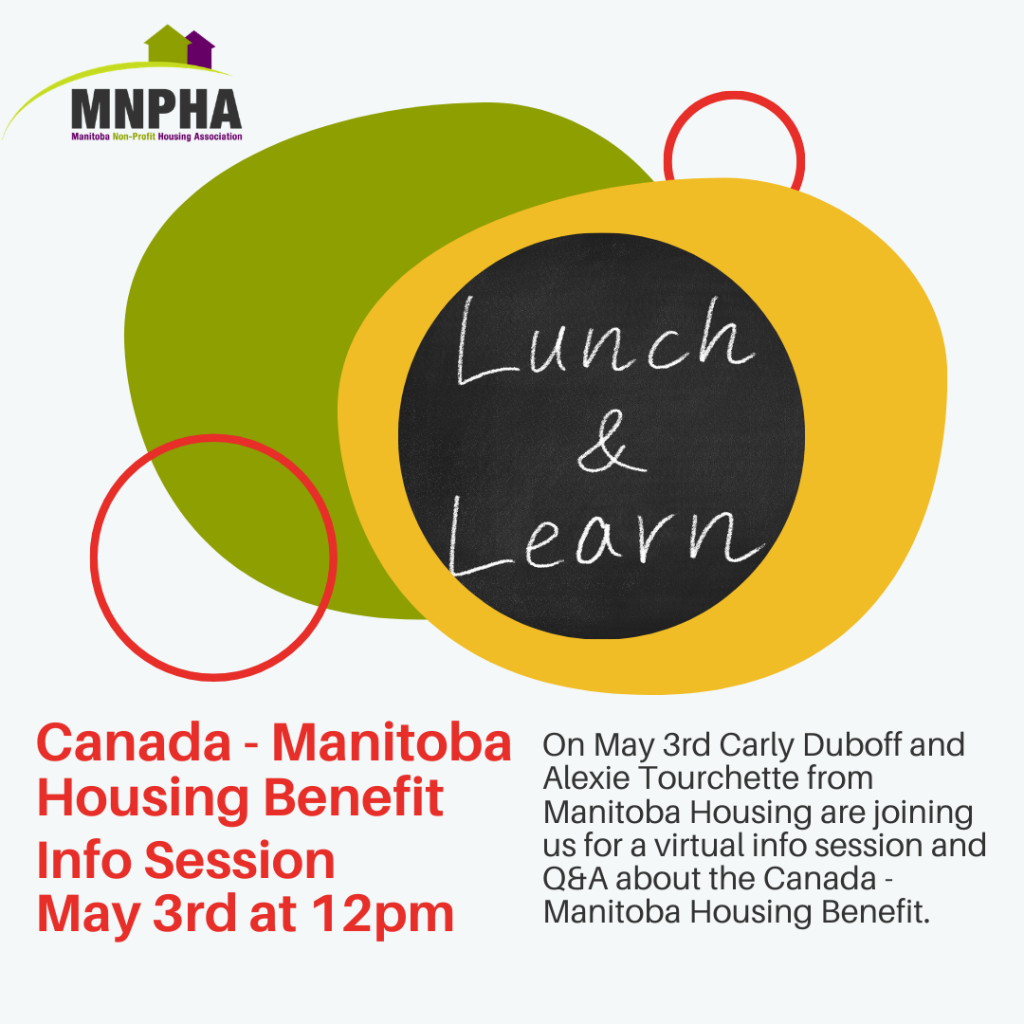

Past Events Mnpha Manitoba Non Profit Housing Association

Here S What You Need To Know To Get Canada S New Dental Benefit And Housing Benefit Canada Today

Canada Housing Benefit News Videos Articles

/https://www.thestar.com/content/dam/thestar/business/2022/12/12/canadian-renters-can-now-apply-for-a-one-time-top-up-of-500-heres-who-is-eligible-for-the-benefit/_500_top_up_3.jpg)

Who Can Apply For The 500 Top Up To The Canada Housing Benefit The Star

500 Canada Housing Benefit Top Up How To Get It Nerdwallet

Cra Who Can Apply For The Canada Housing Benefit Squamish Chief

Webinar Canada Ontario Housing Benefit Achev

New One Time Top Up To The Canada Housing Benefit Sinneave Family Foundation

Trudeau Announces First Steps On Dental Care Boosts To Housing Benefit Gst Credit Cbc News

Canada Housing Benefit The Law Society Of Newfoundland And Labrador